|

Epocrates Streamlines Strategic Focus and Reports Fourth Quarter and Full Year 2011 Results

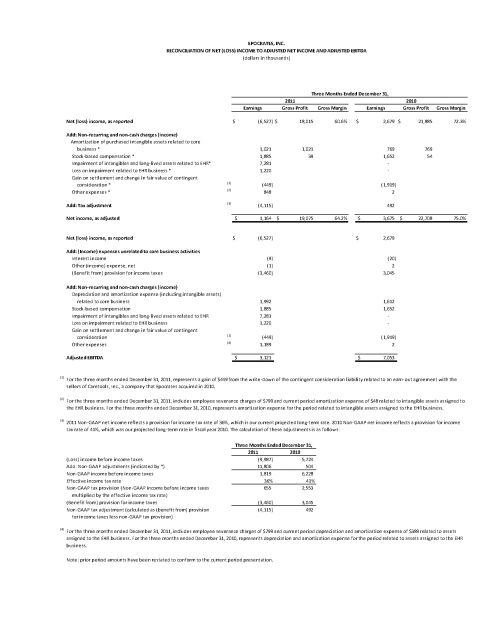

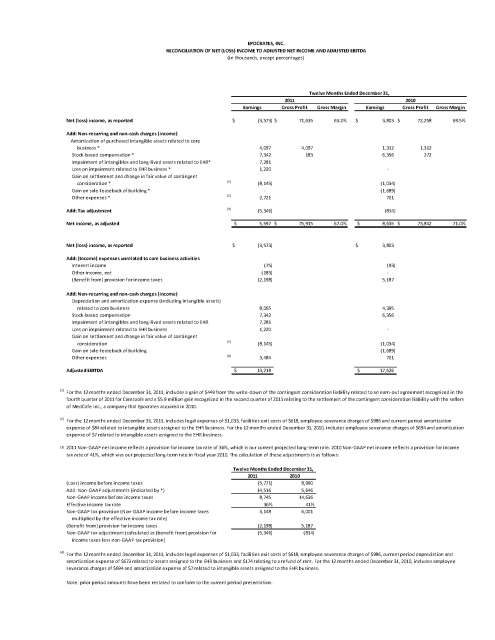

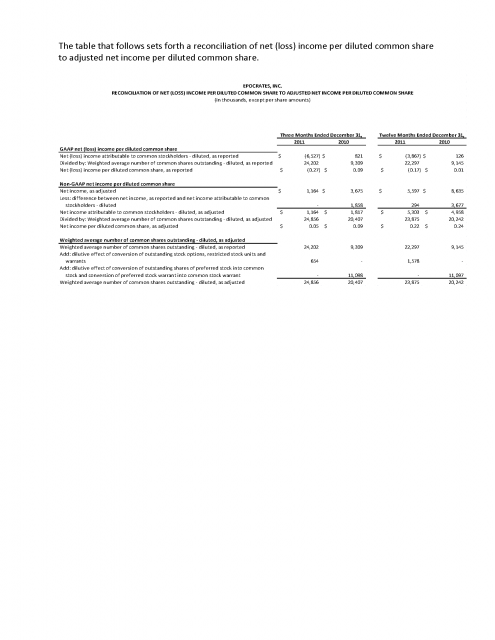

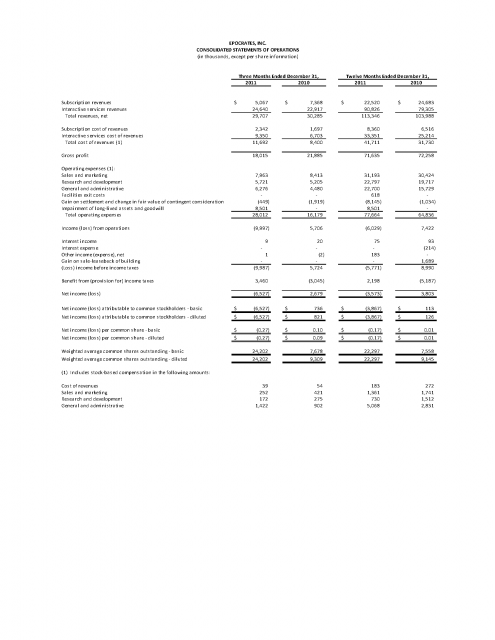

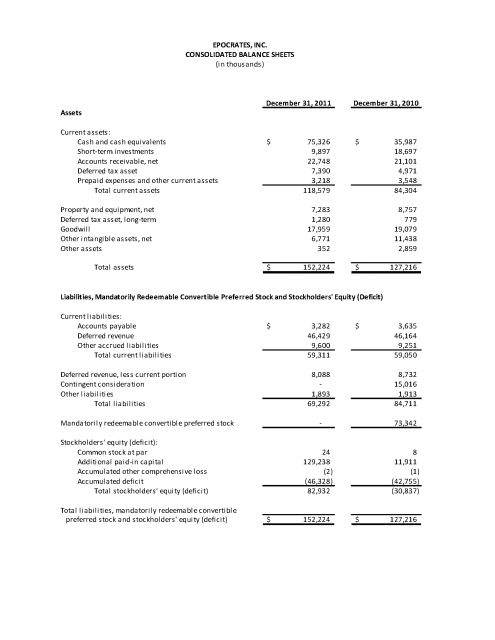

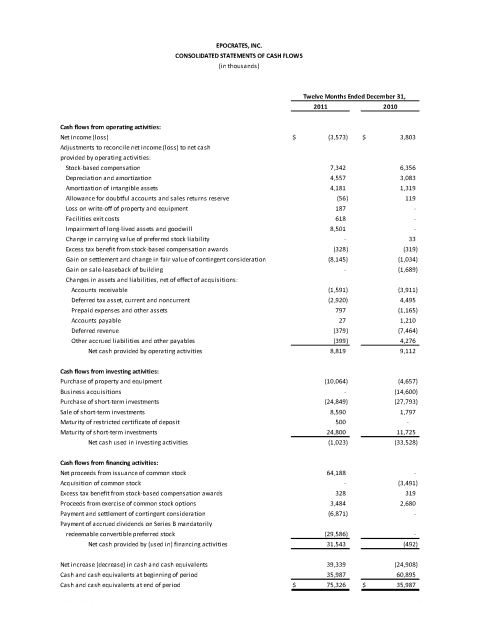

Epocrates Streamlines Strategic Focus and Reports Fourth Quarter and Full Year 2011 ResultsSAN MATEO, Calif. – February 28, 2012 – Epocrates, Inc. (NASDAQ: EPOC), a leading physician platform for clinical content, practice tools and health industry engagement, today announced a strategic streamlining of its business and reported its financial results for the fiscal fourth quarter and full year 2011. "The foundational strength of Epocrates is our physician network," said Peter Brandt, Epocrates' interim president and chief executive officer. "We believe the opportunities to build upon that strength and expand beyond our current product portfolio throughout our physician network are significant and have the potential to generate meaningful revenue streams for the company. While we have developed a meaningful use certified, state‐of‐the‐art electronic health record (EHR), including a native iPad version, the effort has hindered our ability to aggressively pursue such opportunities. As a result, we are exploring strategic alternatives for our EHR offering. By focusing more on the natural extensions of our core business and providing trusted content and collaborative solutions, we have the potential to support physicians to an even greater extent and to significantly grow our company." For the year ended December 31, 2011, Epocrates' revenue increased 9.0% to $113.3 million compared to $104.0 million for the year ended December 31, 2010. Epocrates' revenue totaled $29.7 million in the fourth quarter of 2011 compared to $30.3 million in the same quarter of the prior year, a decrease of 1.9%. For the year ended December 31, 2011, net loss was $3.6 million compared to net income of $3.8 million in 2010. On a dilutive basis, net loss attributable to common stockholders was $3.9 million, or $0.17 per diluted share, compared to net income attributable to common stockholders of $0.1 million, or $0.01 per diluted share, for the same period in 2010. For the fourth quarter ended December 31, 2011, net loss was $6.5 million compared to net income of $2.7 million in the same quarter of the prior year. On a dilutive basis, net loss attributable to common stockholders was $6.5 million or $0.27 per diluted share compared to net income of $0.8 million or $0.09 per diluted share in the previous fourth quarter. The decrease in GAAP and non‐GAAP net income for the year to date and for the fourth quarter of 2011 was primarily attributable to the impairment of long‐lived assets and goodwill associated with the EHR offering. Net (loss) income attributable to common stockholders is calculated as net (loss) income less the preferred stock dividend that was due to Epocrates' preferred stockholders less an allocation of any remaining net income to the preferred stockholders. Upon completion of the company's initial public offering of its common stock, the preferred stock was converted to common stock. Epocrates' adjusted EBITDA, as defined in the GAAP to non‐GAAP reconciliation provided later in this release, was $13.2 million, or 12% of revenue, for the year ended December 31, 2011 compared to $17.6 million, or 17% of revenue for the same period in 2010. Adjusted EBITDA was $3.1 million, or 11% of revenue, for the fourth quarter of 2011, compared to $7.1 million, or 23% of revenue, in the same period last year. The decline in adjusted EBITDA for the year to date and for the fourth quarter of 2011 was primarily attributable to the decrease in gross margin and operating expenses excluding the changes in non‐recurring and non‐cash items. Cash, cash equivalents and short‐term investments totaled $85.2 million as of December 31, 2011. Brandt concluded, "Epocrates' success this year will be defined by our ability to realize the full potential of our physician network – more than 340,000 strong. Our primary focus will be to strengthen our position of trust with physicians, based on value, which in turn will drive enhanced commercialization opportunities for our business." Outlook for Full Year 2012 Earnings Call Information To participate in Epocrates' live conference call and webcast, please dial (877) 398‐9481 (domestic) or (760) 298‐5095 (international) using conference code 44991959, or visit http://investor.epocrates.com . A replay of the call will be available at the same address. About Epocrates, Inc. Use of Non GAAP Financial Measures Adjusted EBITDA is not a measure of liquidity calculated in accordance with U.S. GAAP, and should be viewed as a supplement to—not a substitute for—results of operations presented on a GAAP basis. Adjusted EBITDA does not purport to represent cash flow provided by, or used in, operating activities as defined by GAAP. Epocrates' Consolidated Statements of Cash Flows presents its cash flow activity in accordance with GAAP. Furthermore, adjusted EBITDA is not necessarily comparable to similarly‐titled measures reported by other companies. Epocrates believes adjusted EBITDA, adjusted net income, adjusted net income per share, adjusted gross profit and adjusted gross margin are used by and are useful to investors and other users of its financial statements in evaluating its operating performance because it provides them with additional tools to compare business performance across companies and across periods. Epocrates believes that:

Epocrates management uses adjusted EBITDA, adjusted net income, adjusted net income per share, adjusted gross profit and adjusted gross margin:

Additionally, Epocrates management uses adjusted EBITDA as a significant performance measurement included in its bonus plan. The tables that follow set forth a reconciliation of net (loss) income to adjusted net income and adjusted EBITDA. These tables also show a reconciliation of gross profit and gross margin from a GAAP to a non‐GAAP basis.

Erica Sniad Morgenstern Sr. Director, Public Relations pr @epocrates.com (650) 227-6907 |